Closing Bell 22nd April: Geopolitical Ease Fuels Market Recovery

The S&P/ASX 200 Index rose by 0.9%, driven by reduced geopolitical tensions and positive economic signals from China, showcasing a rebound in investor confidence.

The S&P/ASX 200 Index rose by 0.9%, driven by reduced geopolitical tensions and positive economic signals from China, showcasing a rebound in investor confidence.

Betashares Crude Oil Index ETF – Currency Hedged (Synthetic) (OOO) is an exchange traded fund seeking to provide investment results that correspond to the price and yield performance of the S&P GSCI Crude Oil Index (the Underlying Index), with a currency hedge against movements in the AUD/USD exchange rate. The responsible entity is BetaShares Capital Limited.

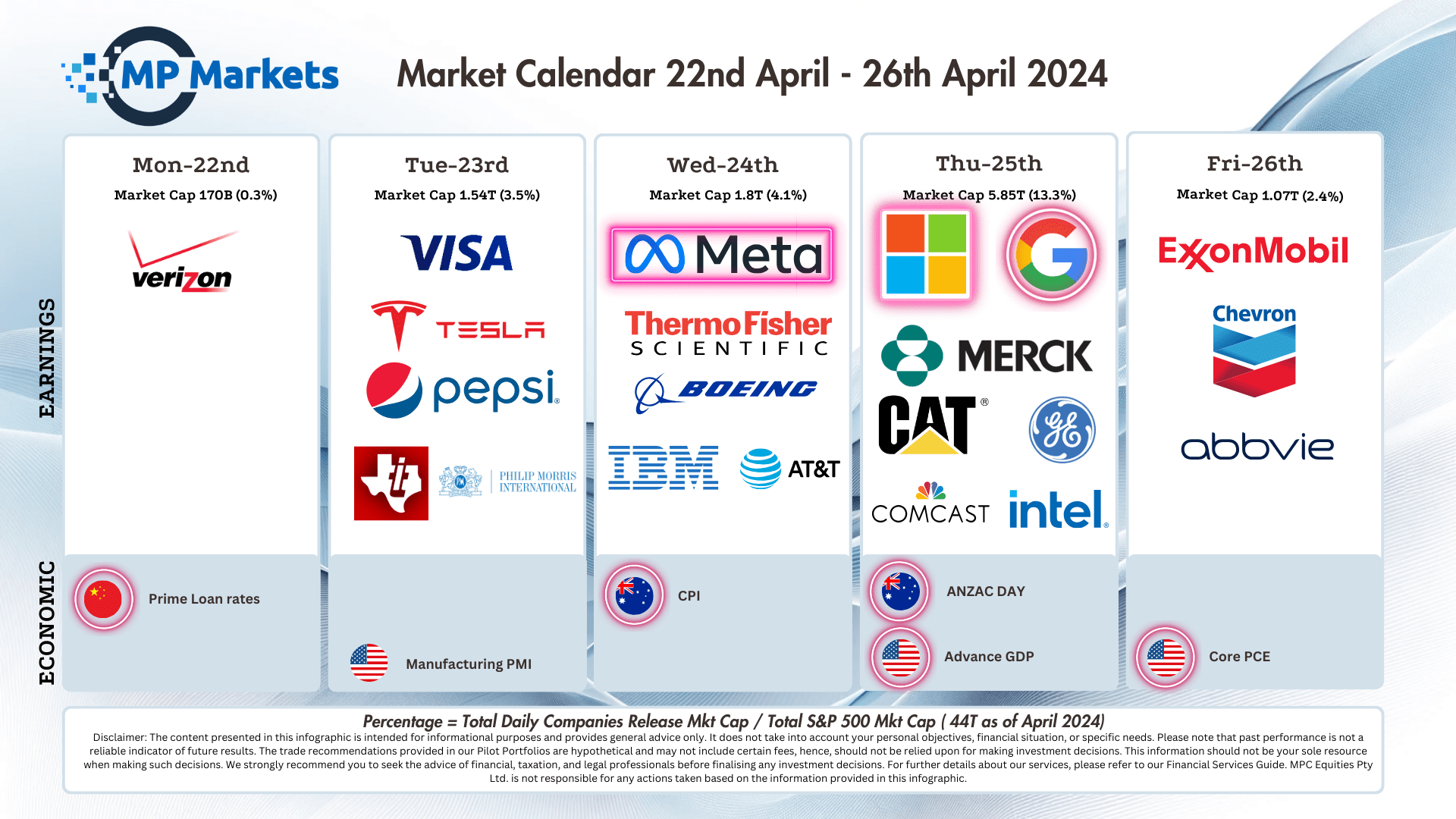

Anticipating next week’s economic figures. Stay informed on the latest financial updates and trends.

Equities notched their 6th straight day of losses to round off the week led by a Netflix and Nvidia rout.

This website provides general advice that does not take into account your individual objectives, financial situation, or needs. Past performance does not guarantee future results. The trade recommendations in our Pilot Portfolios are hypothetical, may exclude certain fees, and are not a basis for future investment decisions. Please do not rely solely on this information. We recommend seeking appropriate financial, taxation, and legal advice before making any investment decisions. Please refer to our Financial Services Guide for more information about our services.