What's Affecting Markets Today

Nvidia surges after market. Nikkei makes a new all time high

S&P 500 futures surged in overnight trading, fueled by Nvidia’s remarkable earnings report. The tech giant announced a record 265% year-on-year revenue growth, attributed to its thriving AI sector, propelling its shares up by 9% in after-hours trading. This performance has significantly elevated Nvidia’s market standing, making it the fifth-largest U.S. company. With the firm projecting continued revenue growth, this momentum is likely to invigorate the broader market, especially within the tech sector. S&P 500 futures increased by 0.7%, Nasdaq 100 futures rose over 1%, and Dow Jones Industrial Average futures saw a modest gain of 42 points, or 0.1%.

The Nikkei 225 index soared to a new peak, reaching 38,924.88 and eclipsing its 1989 record, as strong corporate earnings and proactive investor engagement propelled Japanese stocks to remarkable heights. Recording over a 10% increase this year, following a more than 25% surge in 2023, both the Nikkei and the broader Topix index have significantly outperformed their Asia Pacific counterparts. With robust third-quarter earnings, Bank of America strategists have revised their year-end Nikkei 225 forecast to 41,000 and the Topix to 2,850, further buoyed by the yen’s depreciation, which is nearing a 33-year low against the dollar.

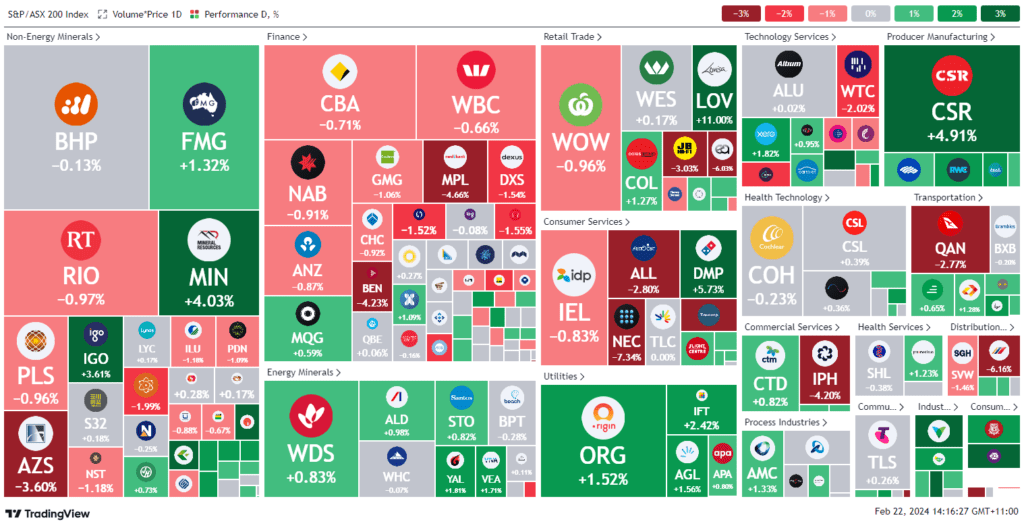

ASX Stocks

ASX 200 - 7,606.6 (-0.1%)

Key Highlights:

The S&P/ASX 200 index dipped slightly by 0.1% midday, reflecting a mixed performance across sectors. Banking and mining sectors faced declines, while energy and consumer segments showed resilience. Fortescue Metals announced a substantial 44% increase in its interim dividend to $1.08 per share, buoyed by robust iron ore prices in the latter half of the year. Qantas Airways revealed a $400 million buyback plan despite a decrease in profits, with its shares climbing 3% early in the session. Fashion retailer Lovisa reported a 12% rise in net profit to $53.5 million for the first half, resulting in an 8% stock price increase. Medibank experienced growth in sales and profits, notwithstanding the financial strain from significant cybersecurity expenses. Nine Entertainment reduced its dividend by 33% amid a challenging advertising market. Both Pilbara Minerals and IGO reported significant profit declines, attributing the downturn to a sharp fall in lithium prices over the period.

Leaders

BGA Bega Cheese Ltd 15.78%

IFL Insignia Financial Ltd 13.50%

LOV Lovisa Holdings Ltd 11.24%

PWH PWR Holdings Ltd 11.21%

FBU Fletcher Building Ltd 9.91%

Laggards

MAF MA Financial Group Ltd -17.26%

TAH Tabcorp Holdings Ltd -14.48%

CUV Clinuvel Pharmaceuticals Ltd -8.41%

NEC Nine Entertainment Ltd -7.47%

BFL BSP Financial Group Ltd -6.36%