Balanced Portfolio Recommendation: ADD 2% Challenger Group (CGF)

ADD to Challenger (CGF) into Earnings on the 13th August

ADD to Challenger (CGF) into Earnings on the 13th August

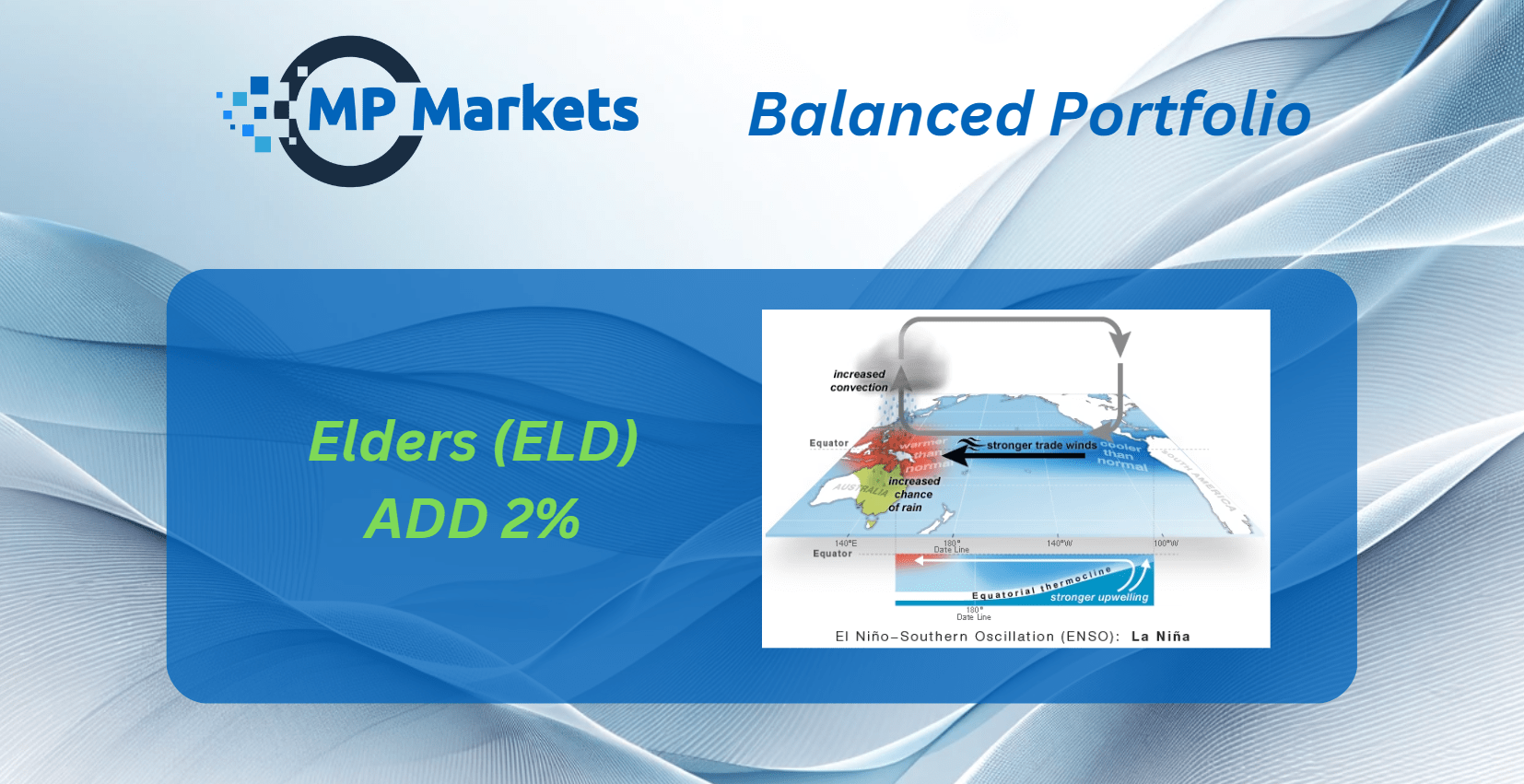

We recommend to add into the weakness due to improving agricultural conditions

Incorporating a 3% allocation to Arcadium Lithium (LTM) within our balanced portfolio represents a prudent investment strategy, given the stock’s attractive valuation relative to its sector peers. This investment opportunity is underscored by LTM’s competitive market positioning and the current undervaluation, suggesting a favorable entry point. Additionally, the stabilization of lithium prices, alongside emerging signs of recovery in the commodity market, indicates a positive outlook for lithium demand. This is particularly relevant in light of the growing electric vehicle and renewable energy markets.

Buy Add – IPD Group Limited, based in Australia, specializes in distributing electrical equipment, offering various solutions under well-known brands like ABB, Elsteel, Emerson, and Red Lion. They provide services such as installation, calibration, maintenance, and more. Serving a diverse customer base including switchboard manufacturers, wholesalers, contractors, and utilities, the company has a long history since its founding in 1889 and was previously known as Alstom Industrial Products Limited before changing its name in 2006.

Buy Add – Stanmore Resources (SMR). Stanmore Resources (SMR) owns and operates the Isaac Plains Complex in Queensland’s prime Bowen Basin region which includes the Isaac Plains Mine and processing facilities, the adjoining Isaac Plains East (operational), Isaac Downs Project (under development) and the Isaac Plains Underground Project.

Boss Energy (BOE) has been the leader of the pack of the ASX listed Uranium companies. It will break out today, so looking to buy into this momentum

Uranium stocks have started to pull back from the most recent run up. Looking for good areas of support to buy PDN as longer term supply deficit in Uranium is still in play

With our Paladin holding a solid 20% in the money, we are recommending a 40% trim to the company specific play and switch to the broader and safer URNM ETF holding to remain involved in the Uranium/Nuclear power thematic.

Investing 1% of our portfolio allocation in PLS presents a compelling opportunity. PLS stands as the most shorted stock on the ASX, with a substantial 20.45% short interest. This indicates potential for a short squeeze, which could lead to a rapid price increase.

Shifting from Ventia to IPD, leveraging Ventia’s 9% return for IPD’s undervalued potential, aligns with our strategy for value-driven, defensive investment opportunities.

This website provides general advice that does not take into account your individual objectives, financial situation, or needs. Past performance does not guarantee future results. The trade recommendations in our Pilot Portfolios are hypothetical, may exclude certain fees, and are not a basis for future investment decisions. Please do not rely solely on this information. We recommend seeking appropriate financial, taxation, and legal advice before making any investment decisions. Please refer to our Financial Services Guide for more information about our services.