Balanced Portfolio Recommendations: SELL – Clinuvel (CUV)

We recommend selling CUV due to the current broader market weakness, with the goal of moving to a cash position to mitigate risk and capitalize on potential future buying opportunities.

We recommend selling CUV due to the current broader market weakness, with the goal of moving to a cash position to mitigate risk and capitalize on potential future buying opportunities.

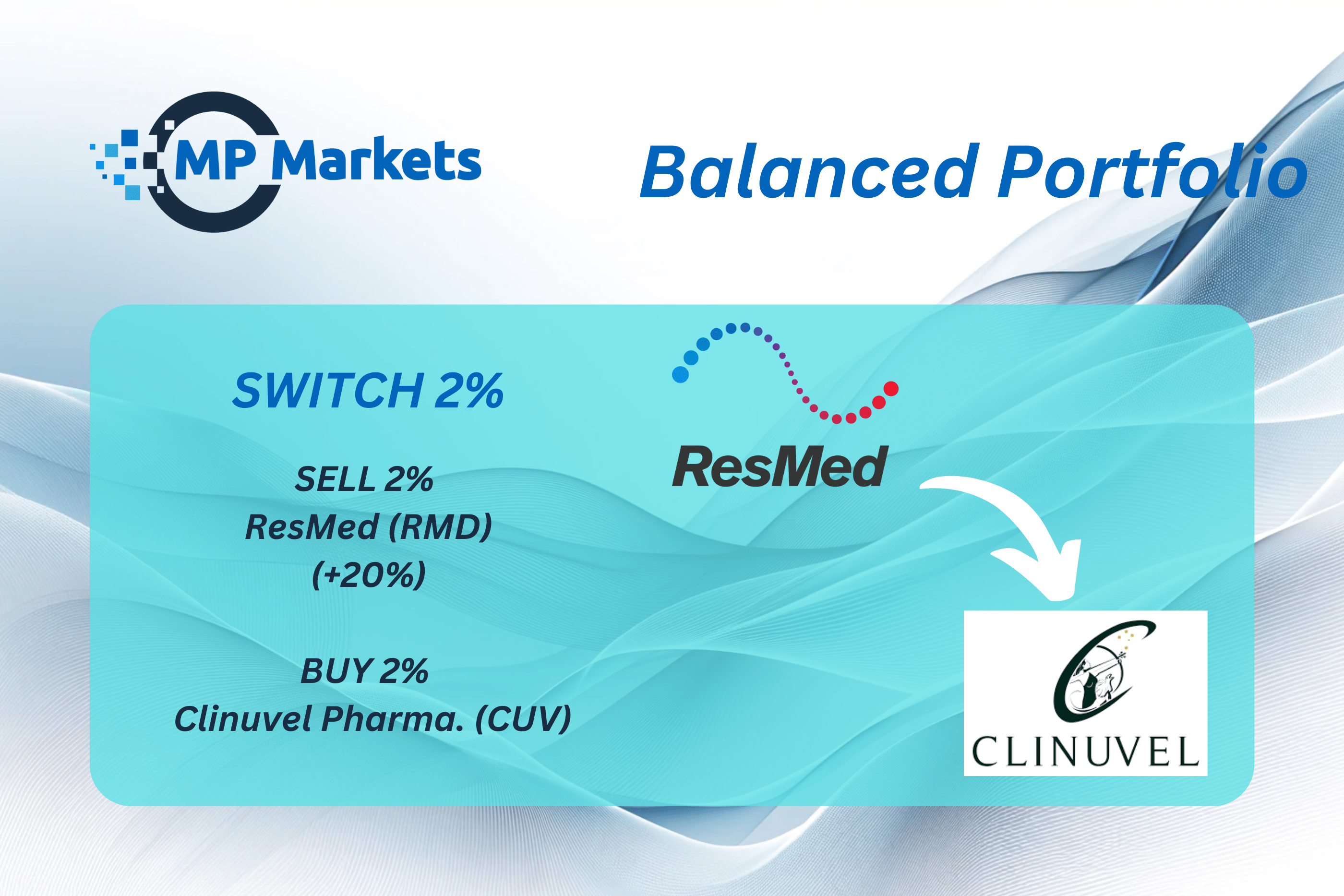

With the recent run in RMD we are looking to bank some profits here at $29 (+20%) while we see further upside in the stock, the risk that further developments in the GLP-1 space could derail this recent run. Particularly a study due from Eli Lily a maker of Zepbound in the next month.

We still prefer exposure in the healthcare space and are recommending a switch of our RMD allocation to Clinuvel (CUV) a skin disease treatment for sufferers of EPP. They are also in Phase 2 of a stroke treatment drug which is looking promising

This website provides general advice that does not take into account your individual objectives, financial situation, or needs. Past performance does not guarantee future results. The trade recommendations in our Pilot Portfolios are hypothetical, may exclude certain fees, and are not a basis for future investment decisions. Please do not rely solely on this information. We recommend seeking appropriate financial, taxation, and legal advice before making any investment decisions. Please refer to our Financial Services Guide for more information about our services.